Understanding The Wind Mitigation Report

If you own a single-family home in the state of Florida, property insurance is a hot topic these days. One of the factors influencing how much your property insurance premium will cost is a wind mitigation inspection. In this post, I will be explaining the process of the wind mitigation inspection and what you need to do to protect your most valuable possession which is your home.

What is a Wind Mitigation Inspection?

A wind mitigation inspection is an assessment of the house’s structural ability to withstand wind damage caused by hurricanes or other severe weather events. Insurance companies use the wind mitigation inspection to give you credits on your insurance policy for each wind mitigation feature you have built into your home.

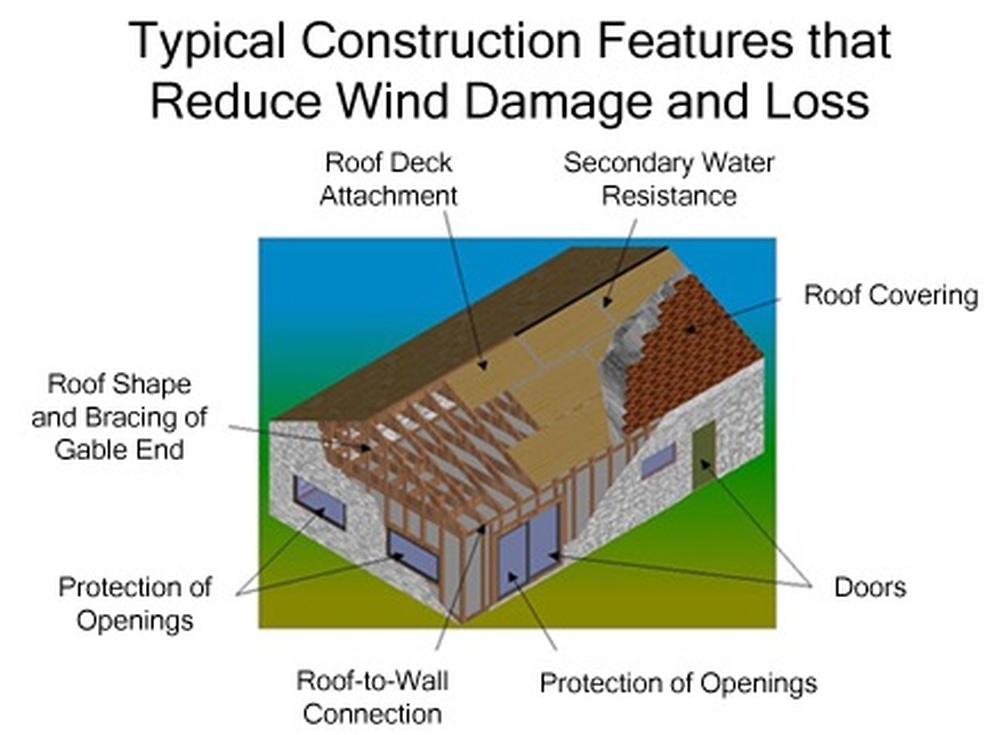

There are many different factors insurance companies take into effect when deciding this. Those factors are the Roof to Wall Connections, Roof Deck Attachments, Roof Covering, Roof Geometry, SWR (secondary water resistance), and the protection of openings (doors/windows). I will briefly explain each wind mitigation feature.

Roof Wall Connection

The above photos are the most common types of roof to wall connections. These roof to wall connections are rated by insurance companies starting with the Toe-Nail connection as being the one of the weakest and the Hurricane Strap connection as one of the strongest. The roof to wall connection strap or clip are designed to literally prevent the roof from completely blowing off in a hurricane or extreme weather event.

Roof Deck Attachment

The roof deck attachment panels can be plywood or OSB (Oriented Strand Board) and must be a minimum thickness of 7/16”. The roof sheathing (plywood or OSB) must be nailed with 8D (eight penny) ring-shank round head nails at six inches on center to be compliant with current FL building standards. Older homes tend to not have these remediations. This doesn’t mean you won’t be able to get insurance on an older home, you just won’t get these types of credits towards the cost of your policy.

Roof Covering

The most common types of roof coverings are Asphalt/Fiberglass Shingle, Concrete/Clay Tiles, Metal, Built Up, or Membrane. This section of the report requires a permit application date, an FBC (Florida Building Code) or MDC (Miami Dade County) product approval number, and the year of original installation or replacement. Your inspector will decide if the roof covering meets the FBC or MDC approval listing at time of installation after the inspection is complete.

Roof Geometry

There are many different styles of roof shapes, but a majority of the roof shape styles in Florida are either Hip, Gable, or Flat. The Hip and Flat roof shapes will receive the most credits from Insurance companies due to their ability to deflect high speed winds. A Hip roof is classified as a roof shape where the roof slopes upward from all sides of the structure and has no other roof shapes greater than 10% of the total roof systems perimeter. A flat roof is 5 or more units where at least 90% of the main roof area has a roof slope of less than 2:12. A gable roof would be classified as an “other roof” on the wind mitigation report due to not having the same design as a hip or flat roof and therefore will not receive the same credits as a flat or hip roof.

SWR (Secondary Water Resistance)

SWR by definition is a self-adhering underlayment that must attach directly to the wood sheathing of the roof to be qualified as an SWR insurance credit. The material applied to the exterior of the roof prior to the roof covering being installed is called modified bitumen or as roofers commonly call it, “peel and stick”. The other major category of SWR Barriers are a particular class of sprayed foam adhesives that coat the inside (underside) of the roof deck inside the attic called closed cell foam. We recommend that the roofer document that SWR is being installed when they pull the permit prior to installing the roof. This will be the easiest way for the insurance company to verify the installation so you can get the credit. The only other way is know if SWR is present if you don’t have an permit or roof invoice is to look for physical evidence in the attic.

Opening Protections (Doors, Windows, Garage Doors)

The purpose of inspecting all openings of the house including the garage, if the garage is attached to the home, is to find the weakest form of wind-borne debris protection installed on the structure. One thing to remember if you replace windows, doors, and/or garage doors, make sure the material is truly impact rated. Even if all the windows are replaced with impact rated windows and you did not replace any of the doors, garage door or have verified shutter protection, it will negate all credits towards insurance. All exterior openings must be verified as impact rated to get the full credit no matter the size of the opening.